FAQs

The frequently asked questions (FAQ) noted below are to assist faculty and staff with their understanding of the tuition benefits. Information provided in the Summary Plan Description (SPD) superseded anything noted in the FAQs. Benefits and eligibility can change at any time, and this is not a guarantee of eligibility or payment.

Jump to:

- General Eligibility Questions

- Employee Reduced Tuition Benefit (courses at Northwestern)

- Enhanced Employee Reduced Tuition Benefit (courses at Northwestern)

- Employee Portable Tuition Benefit (courses outside Northwestern)

- Dependent Reduced Tuition Benefit (courses at Northwestern)

- Dependent Portable Tuition Benefit (courses outside Northwestern)

- Taxable Tuition

General Eligibility Questions

How is my hire date determined for all tuition benefits?

Your tuition benefit eligibility is based on your most recent hire date in a benefits‑eligible full‑time or part‑time position.

- If you leave a benefits‑eligible role and return to another benefits‑eligible role within six months, your prior service and benefits status will be reinstated for tuition benefits.

- If your break in benefits‑eligible service is longer than six months, you will be treated as a new hire, and your tuition benefits will be based on your rehire date.

- Time worked in a non‑benefits‑eligible position (such as temporary roles or student employment) does not count toward tuition benefit eligibility and does not establish a hire date for this purpose.

Important:

This rule determines the hire date used for tuition benefits. It is separate from the rule that determines your required continuous, full‑time benefits‑eligible service prior to the start of the academic term.

Benefits and eligibility are subject to change and are not guaranteed.

How is continuous, full-time benefits-eligible service prior to the beginning of the term calculated?

Some tuition benefits require a specific period of continuous full‑time benefits‑eligible service on the first day of the academic term. This service is calculated using a lookback from the first day of the term for which the benefit will be applied.

To qualify for any tuition benefit, you must be full‑time (or an eligible retiree) at the start of the term. To determine whether your prior employment meets the continuous service requirement, your employment during the lookback period must have been full‑time benefits‑eligible (or part‑time benefits‑eligible before January 1, 2026) without any break in employment or time in a non‑benefits‑eligible role. Any such break interrupts the service period and resets the calculation.

The sections below outline how reinstatement, past part‑time service, and non‑benefits‑eligible service affect your continuous service calculation.

Benefits and eligibility may change at any time and are not guaranteed.

Reinstatement

- If your employment ends for six months or less your prior eligible service is reinstated and your continuous service does not reset upon rehire. The period you were not employed does not count toward the service requirement.

- If your employment ends for more than six months your continuous service resets to zero. This means your service calculation will use time between your rehire date and the start of the academic term to determine eligibility for the benefit.

Part‑time benefits‑eligible service

- Before January 1, 2026: Continuous part‑time benefits‑eligible service prior to transitioning into a full‑time role before January 1, 2026 may count as half credit toward the required service period (e.g., one year part‑time equals half a year full‑time) as long as you do not terminate employment or are not employed in a non‑benefits‑eligible role for more than six months.

- On or after January 1, 2026: Part‑time service on or after this date no longer counts toward tuition benefit service requirements. Part‑time benefits‑eligible service immediately before transitioning into a full‑time role before January 1, 2026 still counts as half credit provided you do not terminate employment or move into a non‑benefits‑eligible role for more than six months.

Non‑benefits‑eligible service

Time worked in a non‑benefits‑eligible position (such as adjunct faculty, temporary staff, or student worker) does not count toward the tuition benefit service requirement.

If you move from a full‑time benefits‑eligible role into a non‑benefits‑eligible position for more than six months your continuous full‑time service resets to zero.

What expenses are not included in the tuition benefits?

Employee Reduced Tuition

What is the maximum benefit for each calendar year for the Employee Reduced benefit?

Those hired before January 1, 2026 may receive a 90% discount on Northwestern tuition to a maximum of $12,000 for courses that earn credit hours or $5,250 for non-credit courses. The $5,250 limit is included in the total $12,000 limit for the year.

Those hired on or after January 1, 2026 may receive a 90% discount on Northwestern tuition to a maximum of $5,250. This limit is regardless of if the course earns credit hours or not.

What is my annual benefit if I am rehired?

When should I apply for the Employee Reduced Tuition Benefit?

You only need to apply once per calendar year. You should apply for the benefit after you enroll in courses in CAESAR for the first time that calendar year. The reduced tuition benefit will be applied to your CAESAR account typically within 5-10 business days from when the application was approved. Note: for applications submitted for Winter term, the discount will not appear on your bill until the December invoice.

Note, the application is approved for a calendar year, not academic year. So if you start classes in September (Fall term) and then apply for benefits at that time, that application is only good for courses that begin before 12/31 of that year. If you continue to take courses in the following year, you will need to apply for that calendar year.

Will my take home pay be reduced if I use the Employee Reduced Tuition Benefit?

If you receive a tuition reduction of over $5,250 in a calendar year, you will owe income tax on the benefit you received and your take home pay will be reduced. See the Tuition Taxation website for more information.

Benefits you received for courses you take in a calendar year are all considered for taxes. Benefits you received through the Employee Reduced, Enhanced Employee Reduced, and Employee Portable Tuition Benefits may be taxed when the total benefit you received through all of these plans exceeds $5,250 in a calendar year.

Enhanced Employee Reduced Benefit

Who is eligible for the Enhanced Employee Reduced Tuition benefit?

Full-time faculty and staff, hired in a benefits-eligible role before January 1, 2026, who have three years of continuous full-time benefits-eligible service before the start of the academic, and whose annual salary is $100,000 or less may use the Enhanced Employee Reduced benefit.

If you are rehired you may not qualify for this benefit. See the How is my hire date determined for all tuition benefits? FAQ noted above.

The benefit does not apply to those hired on or after January 1, 2026.

What is the maximum benefit for each calendar year for the Enhanced Employee Reduced benefit?

Faculty and staff who are eligible for the Enhanced Employee Reduced benefit may receive a 90% discount on Northwestern tuition with no annual benefit maximum for courses that earn credit hours or $5,250 for non-credit courses.

The benefit does not apply to those hired on or after January 1, 2026.

What is my annual benefit if I am rehired?

When should I apply for the Employee Reduced Tuition Benefit?

You only need to apply once per calendar year. You should apply for the benefit after you enroll in courses in CAESAR for the first time that calendar year. The reduced tuition benefit will be applied to your CAESAR account typically within 5-10 business days from when the application was approved. Note: for applications submitted for Winter term, the discount will not appear on your bill until the December invoice.

Note, the application is approved for a calendar year, not academic year. So if you start classes in September (Fall term) and then apply for benefits at that time, that application is only good for courses that begin before 12/31 of that year. If you continue to take courses in the following year, you will need to apply for that calendar year.

Will my take home pay be reduced if I use the Enhanced Employee Reduced Tuition Benefit?

If you receive a tuition reduction of over $5,250 in a calendar year, you will owe income tax on the benefit you received and your take home pay will be reduced. See the Tuition Taxation website for more information.

Benefits you received for courses you take in a calendar year are all considered for taxes. Benefits you received through the Employee Reduced, Enhanced Employee Reduced, and Employee Portable Tuition Benefits may be taxed when the total benefit you received through all of these plans exceeds $5,250 in a calendar year.

Employee Portable

Am I eligible for Employee Portable Tuition Benefits?

To be eligible for Employee Portable Tuition Benefits, your last benefits-eligible hire date must be before January 1, 2020. See the How is my hire date determined for all tuition benefits? FAQ under General Eligibility above for information on rehire/reinstatement rules.

What is my benefit if I am rehired?

What courses are eligible for the Employee Portable Tuition Benefit?

What is the annual Employee Portable Tuition Benefit limit?

The Employee Portable Tuition Benefit will pay a maximum of $5,250 in tuition benefits for courses that began in the calendar year. The annual limit is based on the date the course began, not when the course ends, application is submitted for Reimbursment, or when the benefit is paid. The annual limit is combined with benefits received through the Employee Reduced Tuition Benefits.

If a benefit is paid for courses in the previous calendar year, and total Employee Portable, Employee Certificate, and Employee Reduced tuition benefits paid in the current calendar year exceed $5,250, you will owe income tax on benefits over this limit.

The Employee Portable Tuition Benefit limit is combined with any Employee Reduced Tuition benefits you receive in a calendar year.

Will my take home pay be reduced if I use the Employee Portable Tuition Benefit?

If you receive a tuition reduction of over $5,250 in a calendar year, you will owe income tax on the benefit you received and your take home pay will be reduced. See the Tuition Taxation website for more information.

Benefits you received for courses you take in a calendar year are all considered for taxes. Benefits you received through the Employee Reduced, Enhanced Employee Reduced, and Employee Portable Tuition Benefits may be taxed when the total benefit you received through all of these plans exceeds $5,250 in a calendar year.

Dependent Reduced Tuition Benefit

Am I eligible for the Dependent Reduced Tuition Benefit?

Eligibility for the Dependent Reduced Tuition Benefit is based on your hire date and continuous employment before the start of the term. See the General Eligibility FAQs above for more information on hire date and continuous employment rules.

You must have five-years of continuous, full-time, benefits-eligible employment immediately prior to the start of the term.

You may receive tuition benefits up to 50% of total tuition. Lifetime per dependent limits apply: 8 full-time academic semesters or 12 full-time academic quarters.

When do I apply for the Dependent Reduced Tuition Benefit?

You only need to apply once per calendar year. You should apply for the benefit after your dependent has enrolled in courses in CAESAR for the first time that calendar year. Tv. Note: for applications submitted for Winter term, the discount will not appear on your bill until the December invoice.

Note, the application is approved for a calendar year, not academic year. So if your dependent start classes in September (Fall term) and you apply for benefits at that time, that application is only good for courses that begin before 12/31 of that year. If they continue to take courses in the following year, you will need to apply for that calendar year.

How is the Dependent Reduced Tuition Benefit paid?

Do scholarships and grants reduce the Dependent Reduced Tuition Benefit?

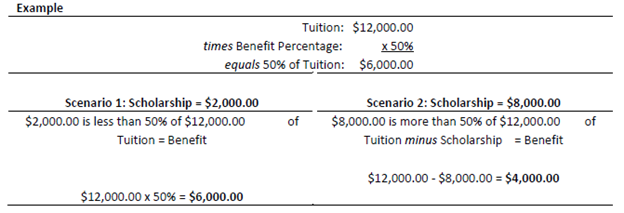

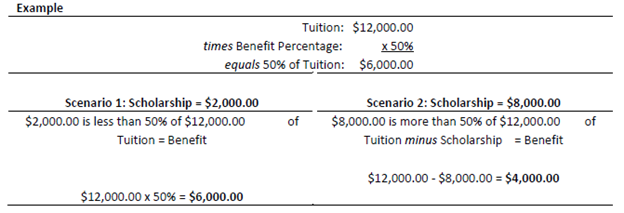

Scholarships and grants are included in the Dependent Reduced Tuition Benefit calculation even if they are not exclusively applicable to tuition. If scholarships and grants equal less than 50% of the tuition, then the benefit is 50% of the total tuition. If scholarships and grants equal more than 50% of tuition, then the benefit is equal to the tuition minus the scholarships and grants (the tuition benefit plus scholarships and grants can never be more than the tuition).

Is the Dependent Portable Tuition Benefit taxable?

Dependent Portable Tuition Benefit

Am I eligible for the Dependent Portable Tuition Benefit?

Eligibility for the Dependent Portable Tuition Benefit is based on your hire date and continuous employment before the start of the term. See the General Eligibility FAQs above for more information on hire date and continuous employment rules.

You must have five-years of continuous benefits eligible employment immediately prior to the start of the term.

Those hired before January 1, 2026 will be eligible for tuition benefits up to 50% of total tuition. Those hired on/after January 1, 2026 will be eligible for tuition benefits up to 40% of total tuition.

Lifetime per dependent limits apply: 8 full-time academic semesters or 12 full-time academic quarters.

When do I apply for the Dependent Portable Tuition Benefit?

Do scholarships and grants reduce the Dependent Portable Tuition Benefit?

Scholarships and grants are included in the Dependent Portable Tuition Benefit calculation even if they are not exclusively applicable to tuition. If scholarships and grants equal less than 50% of the tuition, then the benefit is 50% of the total tuition. If scholarships and grants equal more than 50% of tuition, then the benefit is equal to the tuition minus the scholarships and grants (the tuition benefit plus scholarships and grants can never be more than the tuition).

How is the Dependent Portable Tuition Benefit paid?

Approved Dependent Portable Tuition benefit amounts may be paid to the employee or to the student's institution.

To the employee:

- The application must include proof of full payment.

- Tuition benefits will be processed through payroll and paid via direct deposit. If you have multiple accounts designated for your payroll direct deposit, the tuition benefit may be disbursed to all accounts. Please contact Benefits if you do not want this to occur.

To the institution:

- Checks are made payable to the school.

- Checks are issued by Accounts Payable and forwarded to Benefits for pick up, or mailing to the employee. Northwestern will not mail the check to your dependent's institution directly.

- Employees are responsible for getting the payment from Northwestern to the student's institution.

What is my benefit if I am rehired?

Is the Dependent Portable Tuition Benefit taxable?

Tuition Taxation

Which tuition benefits are subject to income tax?

Can you tell me how the taxes will affect my paycheck?

How do I pay income tax on Employee Reduced, Enhanced Employee Reduced or Portable Tuition benefits?

After the plan pays $5,250 in tuition benefits for the calendar year, the value of the tuition benefit will be added to your paycheck and taxed (tax impute) in the calendar quarter in which you used the benefit. Therefore, you may pay less income tax in January-March because the first $5,250 in tuition benefits were exempt from tax for the year.

If you receive tuition benefits from the Employee Reduced, Enhanced Employee Reduced, and Portable Tuition benefits that in total exceed $5,250 in a calendar, your take home pay will be reduced due to increased income tax withholdings.

Questions? Email askHR@northwestern.edu or call 847-491-4700.