Understanding Your Paycheck

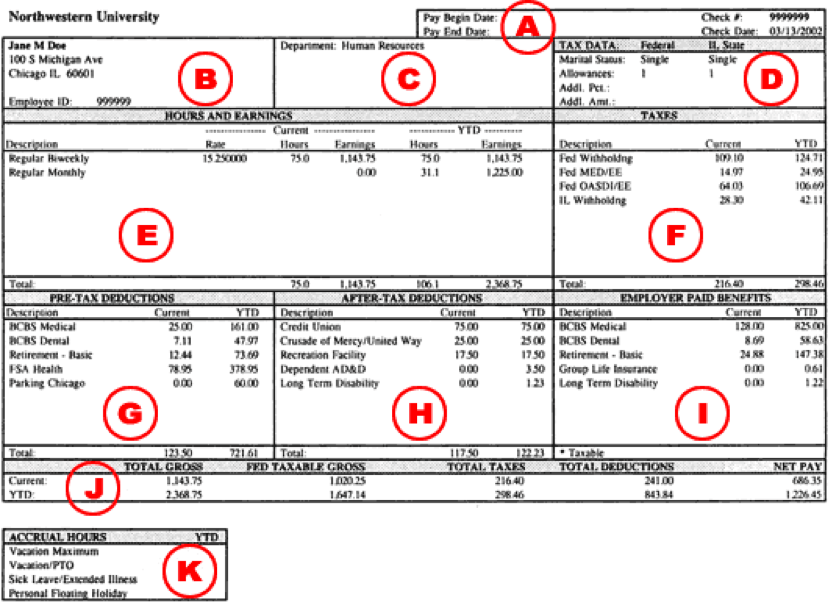

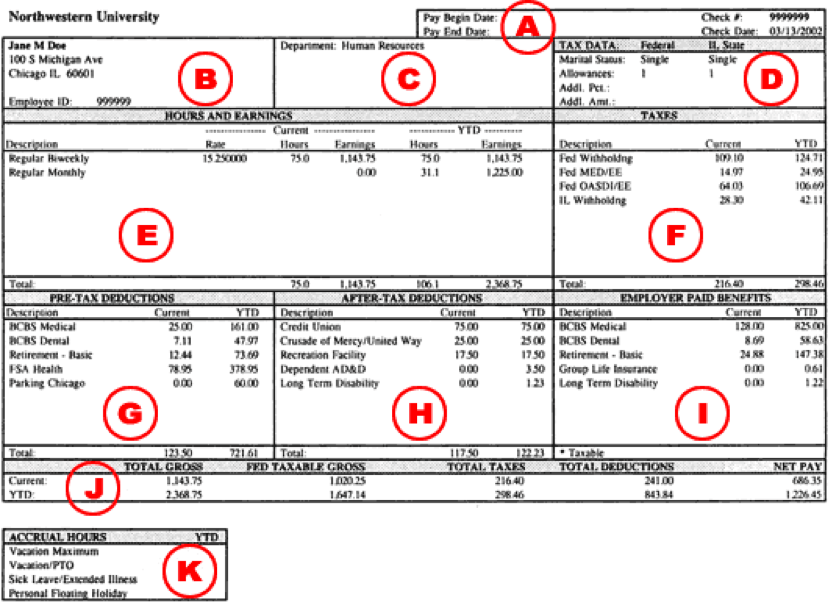

Below is a sample Northwestern paycheck. Review the letters below to see information about what is displayed in that section. Current employees can access a pdf of their paycheck online at any time in myHR. After logging in, click the Pay tile, and then select My Paycheck. Former employees must submit a request to obtain a copy of their pay stub.

To enable the pdf view of the paycheck, go to the Pay tile, Direct Deposit, and Select "NO" for the Print Option. To receive pay stubs in the mail, Select "YES" and pay stubs will be mailed to your preferred address.

Box A: Begin and End Dates for current Pay Period

The Check Date is the actual payday.

Box B: Employee information

Employee's name, Employee ID and current home address.

Box C: Department you are appointed to

If you have multiple appointments, it will display up to five departments.

Box D: Employee’s Federal and State Tax Withholding allowances

If you elected additional withholding allowances or an additional withholding amount, they will be displayed in this box.

Box E: Current and Year to Date Hours Worked and the Hourly Rate for all biweekly employees

For both monthly and biweekly employees it displays the types of earnings, current and Year to Date amounts. If you have more than nine earnings, the additional earnings will be added together and listed on the pay stub as Other.

Box F: Tax withholdings for Current Pay and Year to Date

- Fed Withholding - Federal Tax

- Fed MED/EE- Medicare Tax

- WI Withholding - Wisconsin State Tax

- Fed OASDI/EE- Social Security Tax

- MD Withholding - Maryland State Tax

Box G: Pre-Tax Deductions

Deductions for the current pay period and a total of pre-tax deductions for year to date. These are the amounts deducted from your gross pay before taxes are calculated.

Box H: After-Tax Deductions

Deductions from the current pay period and the year to date deductions on which taxes were calculated.

Box I: Benefit contribution amounts

Contributions made by Northwestern University for current pay and year to date.

Box J: Totals for Current Pay Period as well as the Totals for Year To Date

This includes Gross Earnings, Federal Taxable Gross, Total Taxes, and Total Deductions. The Net Pay amount is the dollar amount you will be paid for that pay period.

Box K: Vacation Maximum for the annual allowance of vacation time

Vacation balances are not tracked on your paystub. To view you current time and sick day accrual balances, log into Workforce.